All around the world Inflation is the biggest concern as we are witnessing the Anarchy in the North African Region, it started from Tunisia, spread to Egypt and now Libya.

The other countries which are facing the civil unrest – Yemen, Algeria, Morocco, Syria, Jordan &Saudi Arabia. The main reason of this Anarchy is Inflation, Unemployment and poor standard of living conditions which finally made the people to come on the streets against their autocratic rulers.

What is the impact of this civil unrest?

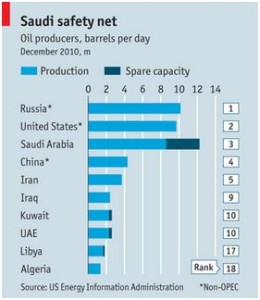

Rising Brent Crude prices, right now it is trading in the range of $110-$115 per barrel, the reason is “Suez Canal”. This is the Canal through which the Brent Crude supply happens the most, this reaches to the European region through this canal. That is why we saw a huge difference between WTI Crude (Refined Version) and Brent Crude. Brent is being widely used and remember we also import Brent only. It is a big dent on current a/c deficit also. If this unrest touches Saudi Arabia then it could create a huge ripple in the Brent Crude prices.

WHY: See the Chart

Japanese Earthquake:

Natural disaster is out of control and it is shaking the economic environment of Japan and other economies also. Energy prices are shooting up and the most important point to mention—–“Eurozone Debt”.

Now how the Eurozone Debt is related with Japanese Earthquake;

Japanese Insurance Companies specially “Nippon Life” bought Euro bonds heavily in the month of January 2011 when they were being issued by Europe for the rescue of PIGS countries (PIGS – Portugal, Ireland, Greece & Spain). It will create a fear of fall in bond prices which might rattle the Eurozone Debt Crisis.

Fear: Nippon Life – Japanese Insurance Company

If Nippon Life start selling its holdings of treasuries, bonds and equities then global equity market could crash down. Nippon Life Insurance Company, the world’s largest insurance firm, reportedly the biggest single holder of United States Treasury and substantial exposure in Indian & global equities.

Developed Markets – US

In 100 years history of US Dow Jones registered a 90% + gain from low level two times only. Once happened in 1935 when it bounced back and fully recovered after great depression and then happened after Second World War.

This time also after touching the low of 6469 in Feb 2009 Dow Jones Index touched a level of 12400 which itself recovery of 100%. Already US is carrying the record amount of Fiscal Deficit which is really bad for any developed economy.

Next What?

Now Dow Jones could start tapering off and could come down to the level of 10800.

Reasons:

- 100% recovery from lower level so almost topped.

- In June 2011 FED could increase the Fed Rate (presently @0.25%) so the ultra loose monetary policy regime will come to an end.

- If Fed Rate increases it could create a huge difference in 3 months LIBOR rate which is @0.30%, it will induce the European region to increase their Int. Rate (presently@ 0.50%) which would ultimately result in downfall of EURO against Dollar.

- GDP rate of US @3% is just an uptick because of Stimulus money to the tune of $2 trillion. This will destroy the value of Dollar in one year.

Emerging Economies & Markets

South Korea resume the trend of Tight Monetary Policy which then followed rigorously by China to control the bubble in real estate prices and huge spending on Infrastructure.

Now it’s the time of our country to tighten the screw. We already increased the Repo & Reverse Repo.

In the coming months RBI will increase the rate by 100bps more from the present level.

Reasons:

- Big Current A/c deficit which stands at $15 billion i.e. 3.5% of GDP.

- Tall high Inflation which is supposed to be highest in this decade.

- M3 supply at 17%.

- Credit –deposit ratio spiked upto 102% which is itself a record.

- Globally prices of Edible Oils increased by 55%, Cereals by 39% and Sugar by 19%. We are the heavy importer of edible oil.

- Food Inflation spiked from 8% to 18% due to bloody hoarding of Onion.

The impact of Monetary Tightening on Banks & Equity Market

Banks:

The total disbursal by banks around Rs. 9Lakh Crores which created a huge imbalance in Credit-Deposit Ratio.

Deposits@16% (Huge Gap)Credits@24%

All because of Stimulus money – cheap credit available to Small Companies and Big Companies. This heavy lending by banks made them prone to heavy NPAs in future. Now for this year RBI instructed all banks to increase the deposit and to make the lending strict by increasing the lending rates.

This will result in heavy pressure on margin of banks.

Bank Nifty could come down to the level of 9700 and SBI upto 2300.

Equity Market:

The roll back of stimulus is already started and it is creating a shock wave. The commodity prices will create a pressure and Metals will remain subdued for another two months.

There are two levels 5055 & 4779 which Nifty Future could achieve.

Reasons:

- All the Base Metals are trading at their peak levels on LME (London Metal Exchange) and Inventory levels are at record high. It is creating a pressure on Metal Stocks.

- Dollar Index could go upto 82 against basket of 6 currencies.

- India is trading at higher valuation against Asian peers in terms of PE Ratio.

Disclaimer: In this article all the opinions and predictions are my personal and it has no relevance or connection with any of the report and views of any broking/equity research company.

Follow

Follow